The following page is targeted at investors qualifying as professional investors and eligible counterparties under MiFID II (Directive 2014/65/EU) only.By continuing you confirm that you qualify as a professional investor or eligible counterparty

Website Product Disclosures in line with Article 10 of the Regulation (EU) 2019/2088 of 27 November 2019 on sustainability related disclosures in the financial sector (“SFDR”) for financial products that have sustainable investments as their objectiveINVESTMENT ADVISOR VENTURE CAPITAL FUND, SCA SICAV-RAIF (the “Company”)

I. Summary

The Company is an investment company with variable capital – reserved alternative investment fund (RAIF) within the meaning of the RAIF Act, which is not subject to the supervision of the Luxembourg supervisory authority for the financial sector, the Commission de Surveillance du Secteur Financier (the CSSF)

The Company is managed by Investment Advisor Venture Capital GP S.à r.l., a private limited liability company (société à responsabilité limitée) and was incorporated under Luxembourg Law on 11 March 2022 by means of a notarial incorporation deed which were published in the RESA on 21 March 2022, as general partner of the Company (the “General Partner”) and ONE Fund Management S.A., acting in its capacity as the Partnership’s alternative investment Company manager within the meaning of the 2013 Law (the “AIFM”). Investment Advisor Venture Studio AG has been appointed to act in its capacity as investment advisor in relation to the Company’s investment activities (the “Advisor”).

The Company recognises that every investment and every business has an impact on our society and. our planet. Investment Advisor acknowledges and integrates this fact in the way we do business and manage our investments. We are committed to ensuring that ESG – environmental, social and governance – principles are at the core of our decision making. Generating superior returns and prosperity for our investment and our planet is a responsibility we take seriously.

The investment strategy of the Company, as described in the main body of the Memorandum in clause 8.2 of the Memorandum, is based on actively choosing investments that have the potential to address climate adaptation and mitigation needs (climate resilience) as well as biodiversity loss / preservation.

II. Sustainable investment objective of the financial product

The investment objective of the Company is to achieve intermediate and long-term capital appreciation by making privately negotiated equity and equity related investments in Series A-C (early growth) European companies (start-ups) which are active in sustainable technologies for climate change mitigation and biodiversity loss restoration. The investment objective of the Company is further described in the offering memorandum of the Company (the “Memorandum”).

To achieve the sustainable investment objective of the Company, a specific focus will be given on the economic activities capable to contribute to climate resilience (adaptation and mitigation), biodiversity and environment conservation and to the positive impact on the United Nations Sustainable Development Goals (SDGs). An analysis of the impact of the underlying investments on the SDGs is conducted and the Investment Advisor uses the goals as indicators to identify positive and negative impacts of an investment on sustainable social, environmental and economic development.

Investments in activities contributing to climate resilience are mainly aligned with the achievement of SDG 7 (Affordable and Clean Energy), SDG 11 (Sustainable Cities and Communities), SDG 13 (Climate Action) and SDG 17 (Partnerships to achieve the Goal) and investments in activities contributing to biodiversity and recovery are mainly aligned with SDG 9 (Industry, Innovation and Infrastructure), SDG 12 (Responsible Consumption and Production), SDG 14 (Life below Water) and SDG 15 (Life on Land).

The sustainable investment objective of the Company is aligned with its corporate purpose of creating a positive social and environmental impact, as reflected in its articles of association.

The Advisor follows its ESG Policy in place to ensure alignment between our ESG Intention and our ESG Governance and its implementation, available on request (the “ESG Policy”).

III. Investment strategy and screening criteria

The investment strategy of the Company, as described in the main body of the Memorandum, is based on actively choosing investments that have the potential to address climate adaptation and mitigation needs (climate resilience) as well as biodiversity loss / preservation.

The investment decision-making and asset management practices of the Company seek to identify areas of risk and opportunity, including ESG factors, that may impact the value and performance of the investments. Acting responsibly enable to preserve the confidence of investors, partners, portfolio companies, the team and collaborators of the Advisor, and the ecosystem.

The Company follows a simple yet coherent strategy: it invests in profitable products and solutions that generate economic returns and have a high potential to generate a positive impact for the planet and its people.

The Advisor refers to Investment Advisor ESG Policy to implement the strategy of the Company and invest in line with its sustainable investment objective. The executive committee of the Advisor has formally delegated authority for ESG co-ordination and developments to a dedicated ESG Committee as part of its ESG Policy.

In that scope, the following investment decision process is followed:

- Prior to making an investment, the dedicated team of the Advisor works with the management of the prospective portfolio company to identify ESG risks and opportunities. and develop more sustainable business practices. It includes considering a company’s operations, its products and services, and potential ESG controversies, resulting in a holistic ESG overview that identifies both risks and opportunities. On site visits are part of the due diligence process.

- In addition, a negative screening process is conducted to ensure that the Company does not invest in technologies or solutions that harm the environment or have negative implications for our people and our biodiversity. Exclusions can vary from zero-tolerance issues, such as child labor to sensitive business activities that require additional investment scrutiny.

- Throughout the investment process, the pre-investment and post investment data are gathered using the Investment Advisor Score Card which includes the data of the investee companies to assess the implementation of ESG factors at the level of each investee companies but also at the level of the portfolio. Such scorecard is divided into environmental, social and governmental factors. For instance, the scorecard reflects the performance of the investee companies using KPIs such as GHG emission, or circularity performance if relevant depending on the sector.

Investments that are not ESG cleared by the ESG Committee of the Advisor, will not be progressed to final investment approvals.

ESG integration is also reflected in the monitor of the investments, through the processes described in point IV.

IV. Monitoring of the sustainable investment objective

The Company, in order to monitor the sustainable investment objective:

- Works with investees to develop and implement an action plan to avoid adverse ESG impacts and to improve ESG risk management over time. In that context, a two to five years strategy is developed with the investee companies, as well as the scorecard, mentioned above, to track performance and monitor progress to encourage ESG business practices.

- Creates ESG indicators using original source data to identify best-in-class investment opportunities. We integrate the ESG indicators as value drivers into classical financial analysis to select individual assets for our portfolios, including diversity criteria.

- Tracks CO2 emissions. It also aims to monitor circularity performance. It is done at a portfolio level and fund level. Includes ex-ante, implementation, and ex-post systems to report its expected and actual impact performance.

A continuous improvement approach is implemented to record, learn from mistakes, and improve the Company’s measurement process, as the needs of investors, stakeholders and regulators evolve.

As a signatory of the UN Principles of Responsible Investments (PRI), the Advisor ensures the application of the PRIs in the overall investment approach. As stated in the ESG Policy, the strategy aligns with the European Investment Fund (EIF) three core values of intentionality, profitability and scalability.

V. Methodologies

In order to measure the attainment of the sustainable investment objective of the Company, the following methodologies are applied:

Setting Impact Targets

Target Setting Mechanism for New Investments

The impact measurement methodology consists of defining one to five climate and environmental, social and/or societal impact indicators (“Impact KPI”) per portfolio company. Impact KPIs are to be designed interactively between the AIFM and the entrepreneur(s) at the time of investment due diligence and should seek to consist of a range of outputs, outcome and impact indicators where possible. They are meant to express the “theory of change” pursued by the impact- driven enterprise

and by Investment Advisor with its investment and consider both the ‘depth’ and ‘breadth’ of impact

generated.

The impact objective pursued against each of these Impact KPIs is to be expressed in quantified targets (the “Target”) on each Impact KPI. These are defined and set by AIFM and the entrepreneur according to the base case business model, and presented to the Company’s Investment Committee (“IC”) for consideration before an investment is approved.

All Targets are clearly communicated and defined to avoid ambiguity as to how these should be measured once the investment has been approved. Where possible, Investment Advisor will seek to reflect the impact generated over the investment’s life using cumulative figures (e.g. cumulative tonnes of CO2e emissions avoided) or averages over a number of years as appropriate (e.g. average % reduction in polluting by-product vs. state of the art baseline level).

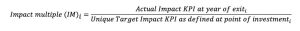

The comparison between the realised value on each Impact KPI and the quantified Target is called the “Impact Multiple” or “IM”. If more than one Impact KPI per investment is defined then the individual Impact Multiples are aggregated at portfolio company level by determining the average of all Impact Multiples defined per investment, resulting in the overall multiple for a portfolio company (“Company Impact Multiple”). It is admissible to assign different weights (wi) to individual Impact Multiples reflecting the importance or the priority of individual indicators. In such cases the Company Impact Multiple will be the weighted average of all Impact Multiples per investment taking into account the weighting assigned to each of these Impact Multiples.

One unique Target (“Unique Target”) for each Impact KPI value is to be defined and taken as the “Target Impact” value for each Impact KPI to be achieved over the lifetime of the investment. Should an investment be sold or otherwise exited prior to the expiry of the first three years of holding period, then the sub-target values per KPI indicatively forecasted for the years 1, 2 or 3 (“Early-exit scenario”) will be applied as the reference value to set the Target for calculating an individual Impact Multiple as well as the Company Impact Multiple. Where the investment is sold or otherwise exited intra-year, the year of reference will be taken to be the next full year other than in exceptional circumstances as determined by the ESG Committee (e.g. an investment is exited the month after the end of the financial year).

Investment Advisor Investors shall not be directly involved in the definition of Impact KPIs. However, the ESG Committee of the Company will validate the Impact KPIs and Targets set for each investment at the first ESG Committee meeting following the investment and may decide to amend or seek clarity on the Impact KPIs as they see fit and pass judgement on any request of the company manager to modify ex-post any Impact KPI on an exceptional basis and in justified cases (see Section Potential change of the Targets during the holding period below.

In Summary:

- 1-5 Impact KPIs set at the point of investment designed to represent the ‘theory of change’ of the proposed investment

- Impact KPIs clearly defined upfront including measurement techniques

- Where possible targets represent the cumulative or average impact over the company’s holding period

- Targets are set for years one to three and a Unique Target is set to forecast the total impact targeted over the life of the investment’s holding period

- Where more than one Impact KPI is set, the weighting between the relevant Impact KPIs are clearly articulated (e.g. 50%, 25%, 25%)

- All targets and definitions are to be clearly communicated to the Company’s IC prior to the investment being approved and ideally documented within the IC papers

- All targets are formally discussed and validated by the ESG committee

Target Setting Mechanism for Follow-on Commitments:

Should Una Terra follow on its initial investments, the following guidance will be applied to previously set Impact KPIs.

- All Impact KPIs articulated at the time of the initial investment are to be continued subsequent to any follow-on investments.

- At the time of a follow-on, the Unique Target has to be re-assessed by the team and presented to the IC within the relevant IC Memo for approval.

- The Unique Target shall be amended to reflect the revised prospects of the investment at the point of a follow-on commitment with the consideration that it may be revised upwards or stay constant, but it may not be revised downwards for the purpose of the impact measurement methodology without the agreement of the ESG Committee. Any downward revisions to the Unique Target requested are to be presented to the ESG Committee and be governed by the process as articulated by the “Potential Amendments of Impact KPI Targets During the Holding Period” below.

- This revised Unique Target overrides the initial Unique Target set at the point of the first investment for the purposes of the Impact Multiple for the investment.

- It is understood that under a follow-on investment, no additional “Early exit scenario” Impact KPI targets (i.e. targets for Y1, Y2, Y3) are set (i.e. the initial ones are maintained).

Additional Impact Indicators, together with a relevant Unique Target, can be added to a

company in the framework of a follow-on.

Potential Amendments of Impact KPI Targets During the Holding Period

It shall be possible to change the Target of any Impact KPI in the course of an investment’s holding period in exceptional circumstances and with the consent of the ESG Committee, subject to two particular situations leading to two different change scenarios:

1. Exogenous factors: In case of a significant changes in the business environment of the company that are beyond the control of the company’s management, the Target may be changed without any particular restriction. The Company manager is required to make the case during the relevant ESG Committee meeting to seek approval on the updated Target by the ESG Committee members. ESG Committee members may request additional information from the Company manager and investee as appropriate to inform this decision.

2. Endogenous factors: If the management of a company decides to pursue a change of strategy or business model that is required for the sustainability of the company and that makes the initially foreseen Target irrelevant, such Target may be changed. The Company manager is required to make the case during the relevant ESG Committee meeting to seek approval on the updated Target by the ESG Committee members. Again, the ESG Committee members may request additional information from the Company manager and investee as appropriate to inform this decision.

Amendments to Impact KPI targets for reasons of non-exogenous underperformance are not to be considered. Any proposals are to be considered at the ESG Committee’s sole discretion.

Reporting on Impact Targets and Calculation of Impact Multiples

AIFMs are expected to report to investors on an annual basis the comparison between the realised impact indicator and the initial Target (the “Impact Multiple” or “IM”).

For the avoidance of doubt, in the case where an investment is held or exited after a holding period of at least three years, the Unique Target defined at the time of investment will serve as the reference point for establishing the impact performance per Impact KPI.

The Company Impact Multiple is the weighted average of all Impact Multiples per investment taking into account the weighting assigned to each of these Impact Multiple.

At fund level, a Portfolio Impact Multiple is calculated by determining the average of all Company Impact Multiples, weighted by the amount invested (€xi) by the fund into each company. As a result, the Portfolio Impact Multiple illustrates Investment Advisor Fund’s impact performance.

Each individual Target is therefore part of the basis on which impact performance measurement is built and the impact methodology compares the Target value(s) of the targeted Impact KPIs defined per investment at the time of investment against the realised value of the respective Impact KPI at the time of exit.

Portfolio Impact Multiple (PIM) and Carried Interest Mechanism

The PIM will be implemented as per the noted process, an extract of which is provided below:

The Company manager is entitled to 20% carried interest above a 8% preferred return subject to the PIM (the “Impact Carry”).

(i) If the PIM equals or exceeds the value of 0.8, then 100% of the Impact Carry shall be distributed;

(ii) If the PIM equals or exceeds the value of 0.60 but is lower than 0.8, then 50% to 100% of the Impact Carry shall be distributed. In such a case, the part of the Impact Carry not distributed shall be transferred to an independent beneficiary (e.g. an NGO, a social enterprise, an impact-driven business incubator…etc.) proposed by AIFM and approved by Investors.

(iii) If the PIM is lower than 0.6, then the Company manager shall not receive any Impact Carry. In such case, AIFM shall propose an independent beneficiary of the Impact Carry (e.g. an NGO, a social enterprise, an impact-driven business incubator…etc.). The independent beneficiary shall be approved by the Investors.

VI. Data sources and processing

The Company developed a scorecard used pre-investment and post-investment, collecting the data of the investee companies to assess the implementation of ESG factors at the level of each investee companies but also at the level of the portfolio. Such scorecard is divided into environmental, social and governmental factors. For instance, the scorecard reflects the performance of the investee companies using KPIs such as GHG emission, or circularity performance if relevant depending on the sector.